reverse tax calculator bc

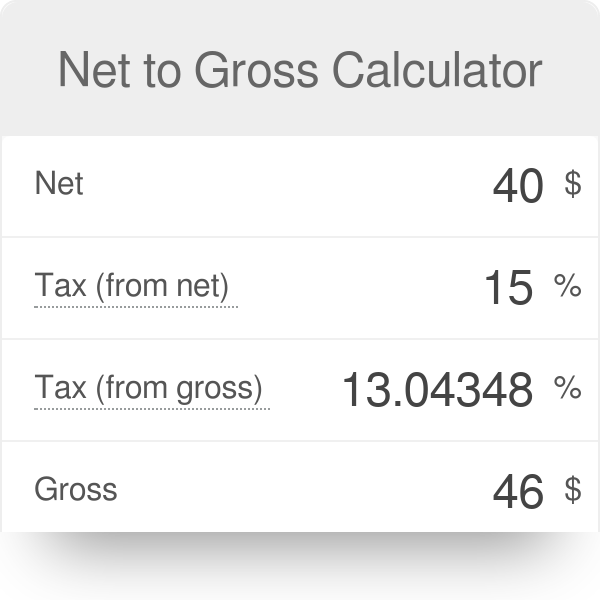

Here is how the total is calculated before sales tax. It is very easy to use it.

Tally Tdl For Sales Register And Purchase Register In Reverse Order T Resume Format Download Download Computer Knowledge

For example a 1000 tax credit can directly be applied to lower the tax you need to pay by the same amount.

. Other provinces in Canada do not use the HST and instead use a distinct Goods and Services Tax GST andor Provincial Sales. Amount without sales tax QST rate QST amount. Now I want to calculate the tax from the total cost.

You have a total price with HST included and want to find out a price without Harmonized Sales Tax. Margin of error for HST sales tax. Where the supply is made learn about the place of supply rules.

The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. Lets calculate this value. Formula for reverse calculating HST in Ontario.

Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to close the total of sales tax used in every businesses. The Calculator is for entertainment purposes only and is not to be relied upon for making. Reverse Calculator Purchase Price Including Net GST.

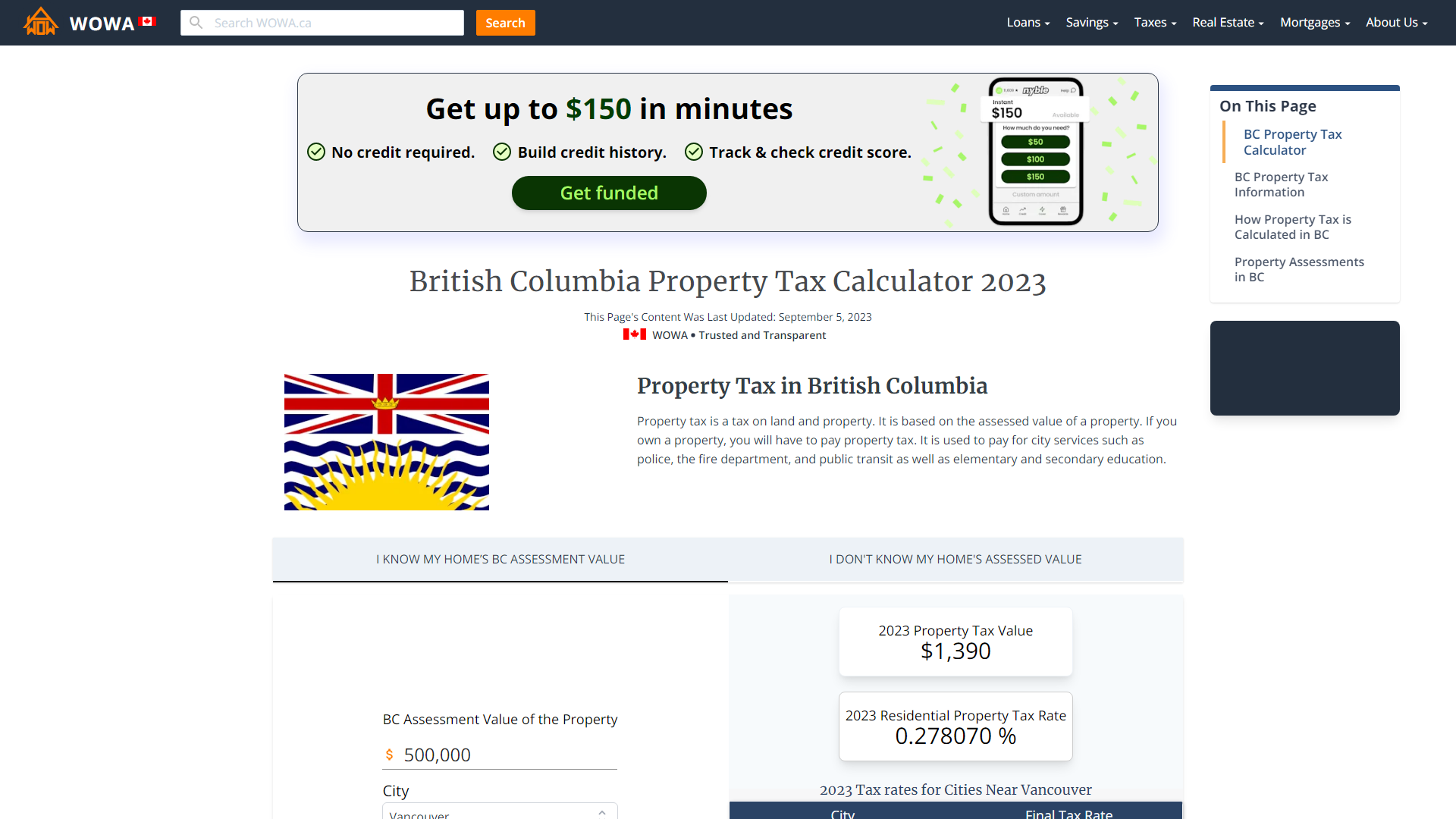

Choose province or territory Choose province or territory Alberta British Columbia. Overview of sales tax in Canada. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

If you have a tax bill worth 13000 you can use the 1000 to reduce your payment to 12000. Purchase Price before GST GST amount to be paid at time of purchase. Alberta British Columbia BC Manitoba Northwest Territory Nunavut Quebec Saskatchewan Yukon GST Tax Rate.

An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. Amount with sales tax 1 HST rate100 Amount without sales tax. The rate you will charge depends on different factors see.

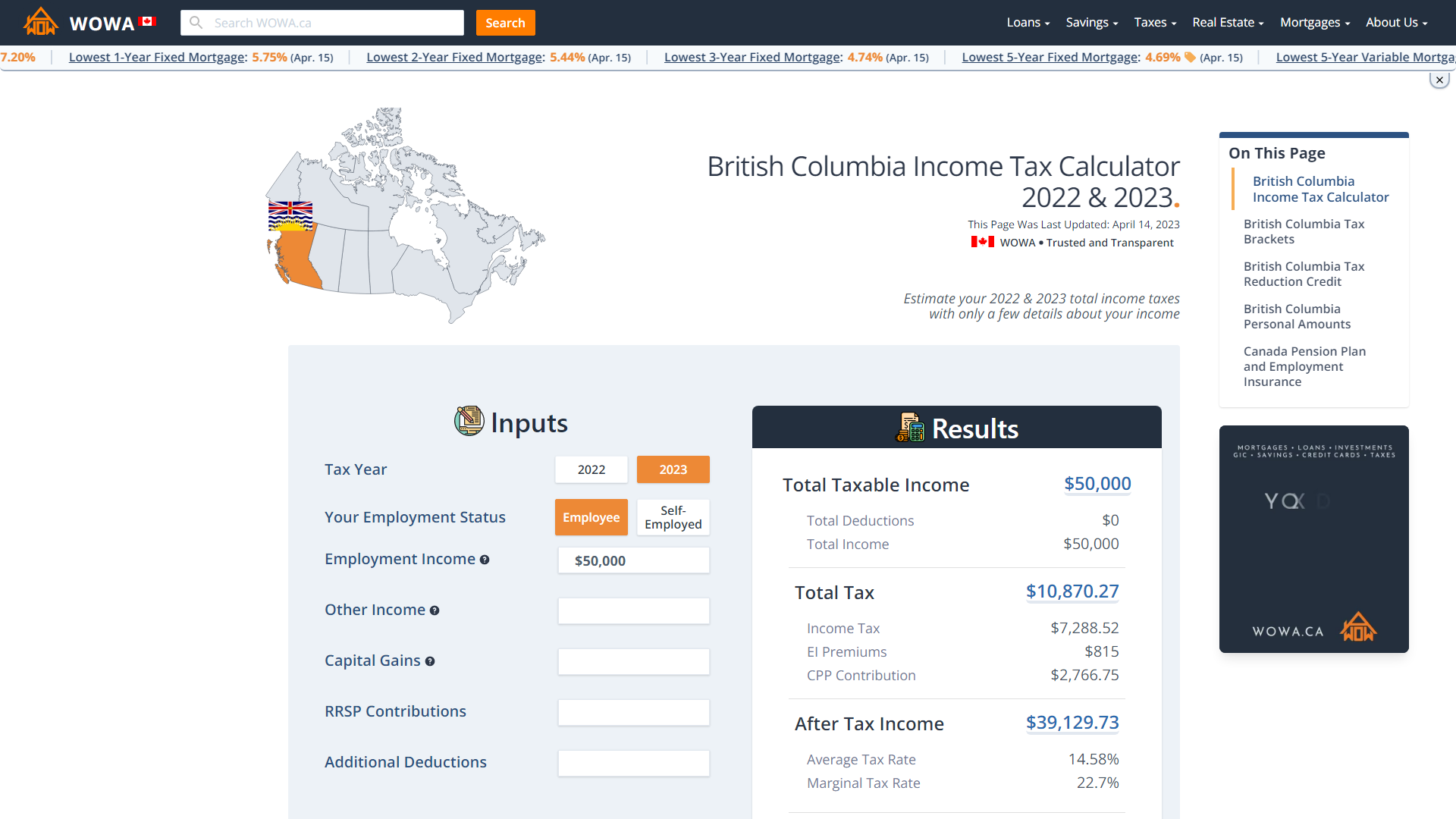

Federal Revenues from Sales Taxes. Who the supply is made to to learn. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021.

Tax reverse calculation formula. Now you divide the items post-tax price by the decimal value youve just acquired. The 5 Goods and Services Tax is expected to bring 408 billion in.

2675 107 25. A tax credit in Canada directly reduces the income tax you must pay. Canadian Sales Tax Calculator GST HST PST This free calculator is handy for determining sales taxes in Canada.

Income Tax Calculator British Columbia 2021. Divide the price of the item post-tax by the decimal value. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

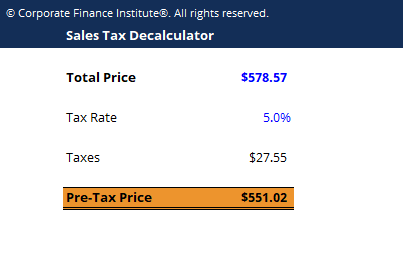

Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. If youre looking for a reverse GST-only calculator the above is a great tool to use. This simple PST calculator will help to calculate PST or reverse PST.

This will give you the items pre-tax cost. GSTHST provincial rates table. Tax Amount Original Cost - Original Cost 100100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount.

Hst reverse sales tax calculation or the harmonized reverse sales tax calculator of 2021 for the entire canada ontario british columbia nova scotia newfoundland and labrador and many more canadian provinces If you make 52000 a year living in the region of british columbia canada you will be taxed 10804. Amount without sales tax x HST rate100 Amount of HST in Ontario. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island.

Provincial federal and harmonized taxes are automatically calculated for the province selected. Reverse Sales Tax Formula. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043That means that your net pay will be 37957 per year or 3163 per month.

This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services. Provinces and Territories with GST. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Type of supply learn about what supplies are taxable or not. This is greater than revenue from BCs corporate income tax and property tax combined. Amount without sales taxes x.

Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC. Calculates the canada reverse sales taxes HST GST and PST. All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator.

Bc sales tax gst pst calculator. The following explanation simplifies the calculation of the tax by displaying only the final result of the Net Income. Enter that total price into Price including HST input box at the bottom of calculator and you will get excluding HST value and HST value.

Reverse GST Calculator. Your average tax rate is 270 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate. GST Rebate claimed at time of purchase This Calculator was created by Conrad Warkentin a Real Estate Lawyer at Rosborough Co.

Calculates in both directions get totals from subtotals and reverse calculates subtotals from totals. Subtract the price of. The following table provides the GST and HST provincial rates since July 1 2010.

Formula for calculating reverse GST and PST in BC. For example total cost is 118 i need a help for the formula to work back 10099118. 2021 free Canada income tax calculator to quickly estimate your provincial taxes.

Current Provincial Sales Tax PST rates are. Amount without sales tax GST rate GST amount. 2021 Income Tax Calculator Canada.

For self-employed workers. Calculation of British Columbia tax. Northwest Territories Nunavut and Yukon have no territorial sales tax at all.

Net Income Taxable Income - Canadian Tax - British Columbia Tax - CPP - EI. For an employee. I have a product used to sell for 118 which includes value of the product is 100 9 of CGST tax 9 of SGST tax which equals 10099118.

The reverse sales tax calculator exactly as you see it above is 100 free for you to use. Following is the reverse sales tax formula on how to calculate reverse tax. The same calculation must be made for the self-employed worker.

Sales taxes also contribute to the Canadian governments budget.

Ten Rupees 800000 Serial Number Note Xf Condition For Sale Price Rs 300 Debt Consolidation Loans Reverse Mortgage Debt Consolidation Companies

British Columbia Property Tax Rates Calculator Wowa Ca

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Have You Refinanced Refinance Mortgage Mortgage Loans Refinance Loans

4 Common Mortgage Killers And How To Survive Them Paying Off Mortgage Faster Refinance Mortgage Payday Loans

Ashworth A02 Lesson 8 Exam Attempt 1 Answers Exam Lesson Mortgage Payoff

Money Challenge How To Save 500 In 30 Days Budgeting Money Money Challenge Budget Saving

Fascinative Canadian Sales Tax Calculator

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Mortgage Tiny Cabins Budgeting Finances Budgeting Budget Saving

721 West Dengar Common Area Townhouse Property

Hector Alvarez 802 432 8672 On Instagram It Is Time To Buy Rates Continue Dropping So Take Advantage And Save B Reverse Mortgage Being A Landlord Mortgage

Bc Income Tax Calculator Wowa Ca

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center