what is the property tax rate in ventura county

What are the taxes in Ventura County. Liability for vessel property taxes attaches to its owner as of 1201 am.

County Of Ventura Webtax Tax Payment History

You Report Revenue We Do The Rest.

. Revenue Taxation Codes. 7 rows Property Tax Rate. The minimum combined 2021 sales tax rate for Ventura County California is 725.

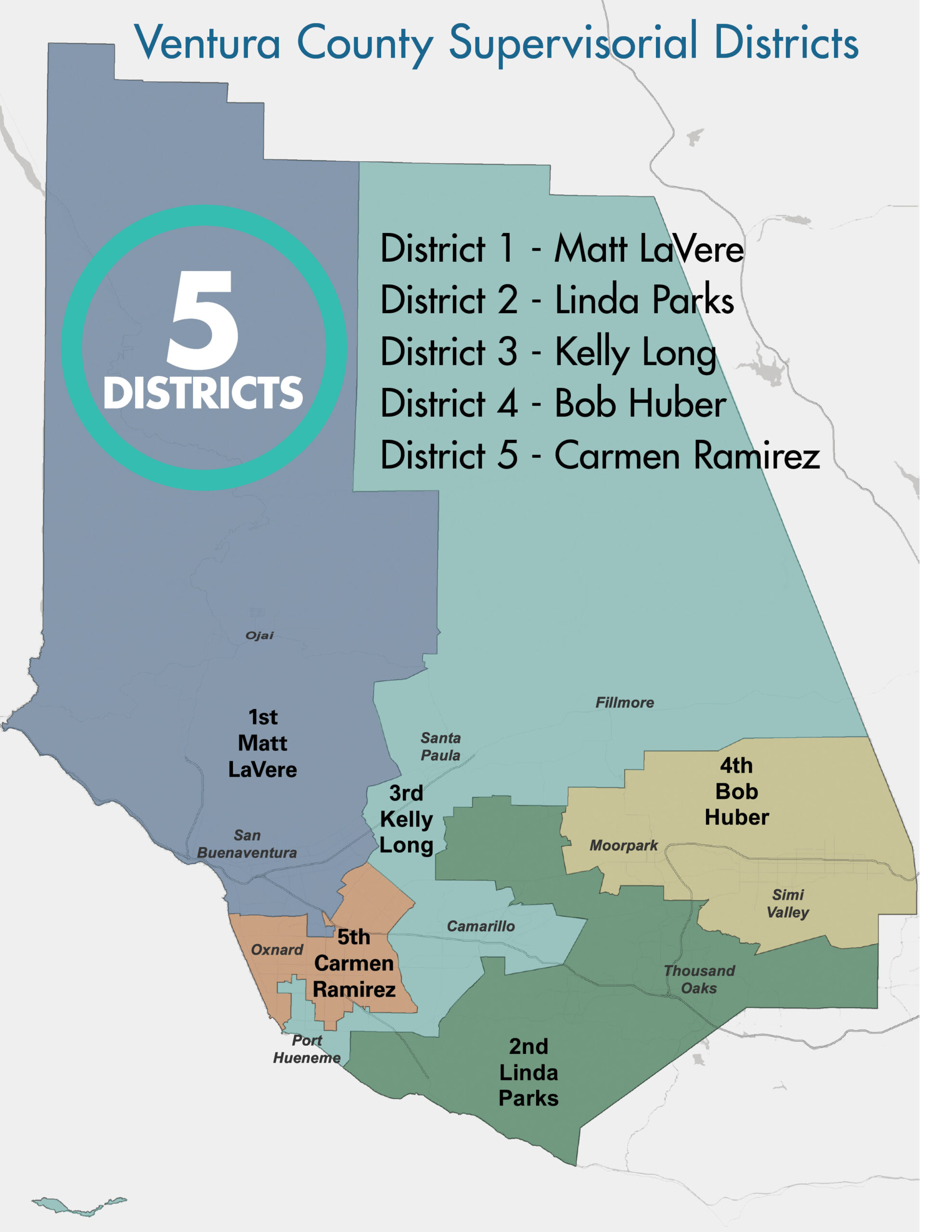

Along with the countywide 072 tax rate homeowners in different cities and districts pay local rates. Beside above how do you figure out tax percentage. Ventura County collects on average 059 of a propertys assessed.

What is the property tax rate in California. The bill for the coming tax year is then issued to the owner of. The Ventura County sales tax rate is 025.

This is the total of state and county sales tax. Keeping this in view what is the property tax rate in Ventura County. The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of.

On January 1 each year lien date. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. You Report Revenue We Do The Rest.

073 Overview of California Taxes Californias overall property taxes are below the national average. The median Los Angeles County homeowner pays 3938 annually in property taxes. The median property tax on a.

11 rows The tax cannot exceed 1 of a propertys assessed value plus bonds and direct assessment taxes. The median property tax on a 56870000 house is 420838 in California. Marin County collects the highest property tax in California levying an average of 550000 063 of median home value yearly in property taxes while Modoc County has the.

Ad Search Any Address in Ventura County Get A Detailed Property Report Quick. Ad Easily File Your Rental Property Taxes. Ad Easily File Your Rental Property Taxes.

Thousand Oaks includes Newbury Park and Ventura area of Westlake Village. The median property tax on a 56870000 house is 335533 in Ventura County. 4 rows SEE Detailed property tax report for 5796 Freebird Ln Ventura County CA Tax description.

Find Information On Any Ventura County Property. Tax Rates and Info - Ventura County. The most straightforward way to calculate effective tax rate is.

Tax Rate Database - Ventura County.

Ventura County Ca Property Tax Search And Records Propertyshark

Second Installment Of 2020 21 Ventura County Secured Property Taxes Due Now 10 Penalty Plus 30 Cost Assessed After April 12 2021

Ventura County Assessor Supplemental Assessments

The Property Tax Inheritance Exclusion

Property Tax California H R Block

California Property Taxes Explained Big Block Realty

County Of Ventura Webtax Supplemental Tax Calculator

Ventura California Ca 93003 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Ventura And Los Angeles County Property And Sales Tax Rates

Where Do U S Homeowners Pay The Most And Least In Property Tax Mansion Global

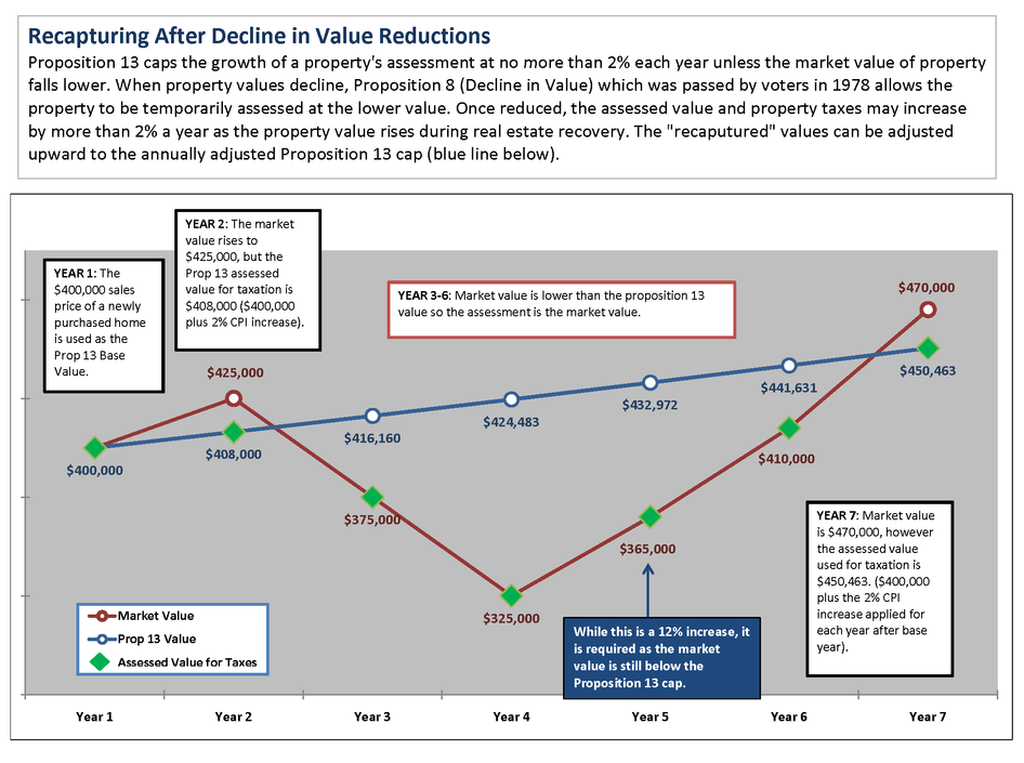

Prop 8 Decline In Value And Prop 13 Property Tax Limits Ventura County

Ventura And Los Angeles County Property And Sales Tax Rates

Pay Property Taxes Online County Of Ventura Papergov

2022 Best Places To Buy A House In Ventura County Ca Niche

Ventura County Ca Property Tax Search And Records Propertyshark